Partner with Experienced Visionary Real State Investors

Up To 20% Annual Returns

No Upfront Managing Fees

Semi-Annual Cash Distribution

Partner with Experienced Visionary Real State Investors

Key Market Identification

We have been using our business strategy since 2016 achieving a growth valuation of $20M in Real State.

Property Acquisition Model

We provide affordable quality housing to low-moderate income communities by rehabilitating and managing distressed properties.

Property Acquisition Model

Awarded Top 1% originator in the country over the past several years and #1 Originator in the country for the single largest retail mortgage broker in the country in 2005.

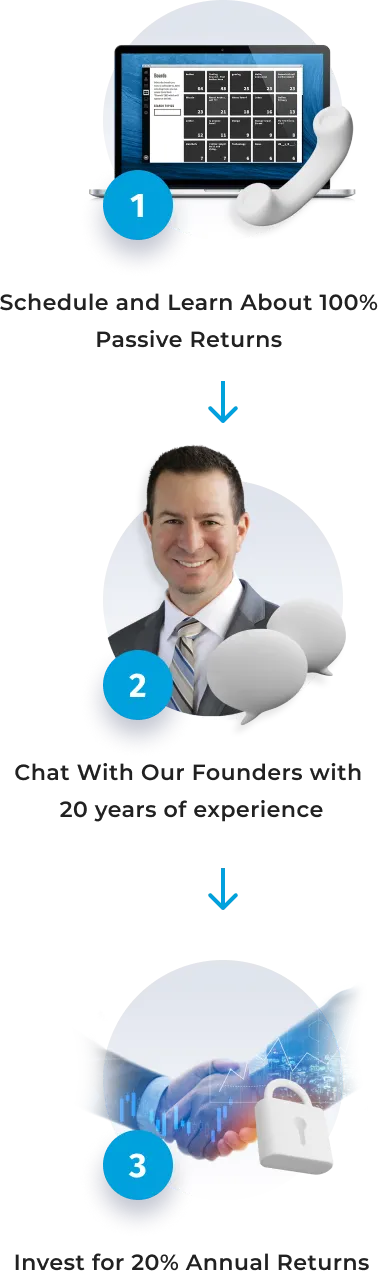

How It Works

Why Now?

Real estate is an excellent hedge against inflation, especially in landlord-friendly States and markets. Rental incomes increase along with inflation.

Mortgages for Commercial Real Estate are still near all-time lows, making it an excellent time for trading commercial

real estate.

The Federal Government recently passed the $1Trillion Infrastructure Investment, which will give us clarity on where the big money is flowing.

Why Us?

While other Reg D investments are property specific which means a potential loss of the principle in case a single project goes sideways, which happens sometimes, what makes Victory Investment Group special is:

We underwrite our own deals.

We invest alongside you.

Our diversified portfolio mitigates the risk for investors

Meet Greg Sandler

Greg Sandler

founder

Greg Sandler started trading real estate with his first home purchase in 1999. In 2002, he decided to sell his prior business endeavor and go all-in into the real estate industry by investing in rental properties and launching his career in the mortgage business. Immediately becoming a top producer in the mortgage industry.

Greg later launched his first branch in 2004 where he grew a team of approx. 30 like-minded mortgage professionals to become the #1 producing field branch for the nation’s largest mortgage brokerage.

Fast forward to 2020 and Greg Sandler is now a Senior Vice President in the Sacramento CA region for the nation’s largest independently owned retail mortgage banker. In 2020, Greg’s team of 80 dedicated mortgage professionals funded nearly 2,100 loans for a total volume of just over $700 Million.

Still passionate about real estate investing, Greg is focused on growing the rental portfolio of USA Investment Group to 1,000 units while providing a high-quality standard of living for all residents who lease with USA Investment Group.

sample of Our Current Deals

The Murray Building

London OH

- Acquisition Price

- $355,000

- Rehab/CAPEX

- $40,000

- Total Project Cost

- $395,000

- Occupancy Upon Acquisition

- 50%

- Gross Rent Upon Acquisition

- $4,500

The Murray Building

London OH

- Valuation Price

- $900,000

- Occupancy Upon Acquisition

- 95%

- Gross Rent

- $10,500

- INTERNAL RATE OF RETURN DURING THIS TIME PERIOD

- 12%

- Net Operating Income Annually

- $84,403.60

We sought out a local bank to procure a cash-out refinance to replenish our internal investor to put those funds back to work on the next project. On October 31st, 2019 the bank appraised the property. Due to the increased cash flow of the property, as well as the improved condition the appraiser determined the valuation to be: Nine Hundred Thousand Dollars ($900,000.00) The bank offered us a new 20-year loan for $425,000, which replenished all of our capital into the building and then some.

2013 Crown Way West Sacramento 95691

Property Location

Property Description

Date Acquired

Acquisition Price

Rehab Budget

Disposition Price

Date Dispositioned

Adj Gross Profit

Loan Amount from Funder

Approx Return to Funder

Duration of Loan

Annualized Return

West Sacramento, CA

Single Family Residence

1/7/2020

$174,500.00

$77,866.00 (approx.)

$334,500.00

5/10/20

$15,550.55

$58,500.00

$10,115.27 (a 17.29% return)

Approx 4 months

51.87%

This was an “ugly house” rehab project. The home was a ‘heavy lift’ repair and needed updating throughout. This project was turned in approx. 4 months, yielding a 17.29% return to the funder.

2004 Crown Way West Sacramento 95691

Property Location

Property Description

Date Acquired

Acquisition Price

Rehab Budget

Disposition Price

Date Dispositioned

Adj Gross Profit

Loan Amount from Funder

Approx Return to Funder

Duration of Loan

Annualized Return

West Sacramento, CA

Single Family Residence

12/11/2019

$163,500.00

$77,866.00 (approx.)

$340,000.00

6/5/20

$22,616.94

$58,500.00

$14,818.47 (a 25.33% return)

Approx 6 months

50.66%

This was another “ugly house” rehab project. The home was a ‘heavy lift’ repair and needed updating throughout. West Sacramento is a community we like to invest in because of the proximity to downtown, but with lower entry prices. This project was turned in approx. 6 months, yielding a 25.33% return to the funder.

2935 Argonaut Ave Rocklin CA 95677

Property Location

Property Description

Date Acquired

Acquisition Price

Rehab Budget

Disposition Price

Date Dispositioned

Adj Gross Profit

Loan Amount from Funder

Approx Return to Funder

Duration of Loan

Annualized Return

Rocklin, CA

Single Family Residence

10/13/2020

$395,000.00

$40,000.00 (approx.)

$555,000.00

(currently pending, COE 1/15/2021)

$89,270.16

$121,000.00

$48,265.08 (a 39.89% return)

Approx 3 months

159.55%

This project was a simple single family home rehab project. The home was considered a cosmetic repair and needed updating throughout. Rocklin is a premier community, with some of the best schools in the region, which leads to a short time on the market. This project is estimated to be turned in just 3 months, yielding a 39.89% return to the funder.

1529 55th St Sacramento 95819

Property Location

Property Description

Date Acquired

Acquisition Price

Rehab Budget

Disposition Price

Date Dispositioned

Adj Gross Profit

Loan Amount from Funder

Approx Return to Funder

Duration of Loan

Annualized Return

East Sacramento, CA

Single Family Residence

8/6/2020

$369,500.00

$72,661.00 (approx.)

$551,000.00

11/12/20

$37,352.80

$157,000.00

$23,386.40 (a 14.9% return)

Approx 3 months

59.6%

This was a great deal in the hot market of East Sacramento. The home was a lighter cosmetic repair and needed updating throughout. East Sacramento is a hot neighborhood with low days on market and a booming demand. This project was turned in approx. just 3 months, yielding a 14.9% return to the funder.

Our Investment Details

Victory Investment Group are raising $20M funds and we are offering our investors:

20% potential annual returns with no upfront managing fees.

Cash flow via distributions.

FAQ

What makes Victory Investment Group a better option than its competitors

As an investor in our fund, your hard-earned money will be secured with liens on a diversified portfolio of high-quality income-producing real estate, that has been fully underwritten by our expert team.

We’re invested side-by-side with our investors as Limited Partners so we have a vested interest in doing everything possible to yield high returns to our Investors.

What returns can I expect from investing with Victory Investment Group?

We Expect 20% potential annual returns with no upfront managing fees.

Cash flow via distributions.

Why is now the time to invest with Victory Investment Group?

Real estate is an excellent hedge against inflation, especially in landlord-friendly States and markets. Rental incomes increase along with inflation.

Mortgages for Commercial Real Estate are still near all-time lows, making it an excellent time for trading commercial real estate.

The Federal Government recently passed the $1Trillion Infrastructure Investment, which will give us absolute clarity on where the big money is flowing. We intend on working in the markets receiving this stimulus as it will likely drive up rents, creating a need for affordable housing.

When do I start seeing returns?

Our returns are distributed annually and monthly.

What is my role as an investor?

As your investing partners, we do all the heavy lifting for you to make sure that your hard-earned money will be secured. We provide quarterly and annual reports for you to be on top of things.

Why Choose Real Estate for an investment?

It’s the question you have been asking yourself for some time now, maybe you still didn’t find your answer yet, and we were no different from you.

It was obvious for us at the beginning and still is… there isn’t any other portfolio that gives this level of security for an investor like me, like YOU!

I mean I don’t see how we can lose money investing in Real State?! But I kept digging for a logical answer as I needed more assurance. But I couldn’t find what I was looking for. It is really challenging to lose money investing in Real State unless you really don’t know what you are doing.

And that took me to another question, Do I really know what I’m doing investing in the Real State?

Well, for someone who has been running a retail business living in the back of his own store the answer was obvious, NO I DON’T KNOW ANYTHING ABOUT REALSTATE.

But why should I ?! Unless I’m running my own real estate business why should I as an investor acquire all that knowledge?

I found out that I shouldn’t really know much about Real State to invest in it because this is what passive investors do.

And this is what we do in Victory Investment Group, We make sure that your money is safe, secure, and well invested.

Armed with our proven experience in the Real State since 1999, we do all the heavy work for you:

We underwrite our own deals so we can land our best investment opportunities to get the highest returns for us as investors and for you as our limited partner.

We also invest side by side with you in the same deals, so we share the same interest in getting the highest returns.

Additionally, We believe that one of the major benefits of investing in Real State is the cash-on-cash return, which we offer to our investors monthly.

But it is not only about the Reward!!

We have a mission of providing quality housing to low-moderate income communities, by rehabilitating and managing distressed properties.

We add value to these communities through the rehabilitation and active management of historically distressed B and C class multi-unit residential properties. We deploy desperately needed capital into these markets, which provides fixed, steady, asset-based secured returns to our members and partners.

We are mission-driven to provide quality affordable housing for residents within the communities we serve. We aim to do our small part to help tackle the nationwide housing shortage problem.

You know, there’s a saying “do what you love to do and the money will follow… To that point, we've been trading real estate for over 20 years and it's helped our families build wealth over the years. Our friends and associates have always asked how they can participate in some of our projects. So finally, we've launched this fund to do just that. We’re honored to help others build wealth within the real estate market while executing our mission of providing quality housing within targeted communities.

And with inflation hitting every country in the world, there has never been a better time to invest in Real State.

You see Real estate is an excellent hedge against inflation, especially in landlord-friendly States and markets. Rental incomes increase along with inflation. Also, mortgages for Commercial Real Estate are still near all-time lows, making it a great time for trading commercial real estate.

This is what Victory Investment Group is capitalizing on, offering you 20% potential annual returns. This is the deal that you never pass on because it is not going to last.

This is the opportunity we are offering you.

So schedule a call with us today, and let’s talk.